In 2019, only negative changes occurred in the system of fringe benefits however, the change in the mid-term social contribution tax had a positive effect. Cafeteria rules that come into effect in 2019 will continue to apply in 2020.

Fringe benefits

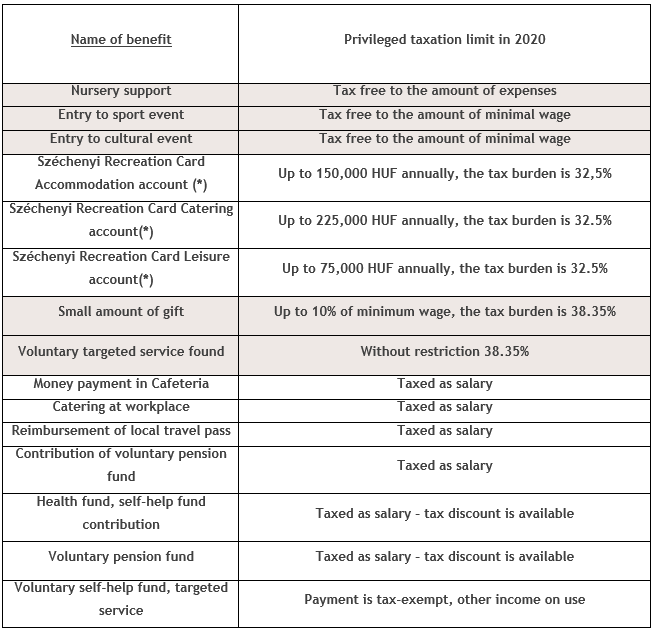

Taxes on fringe benefits are calculated with a 15% personal income tax and 17.5% social contribution tax. (Do not have to use the 1.18 multiplier for the tax base.) As a result of this, the multiplier is 32.5%.

The scope of the privileged taxed elements remained the same. Széchenyi Recreation Card can be given with the well-known sub-accounts and budgets. (Accommodation – 225.000 HUF/year, catering – 150.000 HUF/year, leisure time – 75.000 HUF/year)

Next year we still have to pay attention to SZÉP Card allowance because it has combined limit of 450.000 HUF. So annually this amount could be given from this with privileged taxation. This combined limit refers to the net amounts. Over this maximum amount the tax burden of certain specified allowances will be valid.

Certain specified allowances

For certain specified allowances we have to multiply the value of the allowance with 1.18 and for this we have to count 15% personal tax income and 17.5% social contribution tax. So we could calculate 38.35% tax burden.

With this tax burden we could provide a small amount of gift allowance and we could hand over the Voluntary Fund targeted services in case of Voluntary Pension Fund and Voluntary Health Fund.

Tax-free allowances

From the well-known tax-free elements the nursery support remains in the tax-free category. The rule will continue to apply in 2020 which says that the benefit will be tax-free in case the invoice is issued on the name of the employee not only the employer.

The Entry to Sport or Cultural events will be tax-free too and both of them will be guaranteed to the minimum wage limit.

The value of the certain specified and the tax-free allowances shouldn’t be calculated into the frame amount of 450,000 HUF.

Funds – extension of tax discount

The employee can receive tax return even after the employer’s contribution in 2020 as well.

Taxation will be the following:

From 138.350 HUF we have to deduct the employers’ tax burden of gross allowances. 138.350/1,19=113.765 HUF gross amount could be transferred from the 2020 budget by the employer. Before the transfer we will have to deduct the employee’s burdens which is 33.5%.

Thus, the employer can transfer 113.765*0,665=75.653 HUF to the Fund, from which the employer and the employee burdens have been paid previously and the employee can get 20% tax return. After the return there will be 75.653*1.2=90.784 HUF on the employee’s account.

Allowances in 2019

In 2019, nearly 700 employees who used BDO’s Cafeteria consulting service claimed 54% of the value of cafeteria benefits to SZÉP card, while this value was only 39% in 2018. The second most popular item was the cash option. This represented 40 percent of the benefits, so its popularity also grew significantly in 2019 because it was only 20% in 2018. The voluntary health and pension fund only distributes 3.5%. The nursery, entry to cultural and sport events only shares 1.5%. The remaining 1% includes gift card, student loan repayment support and housing support.

|

(*) Have to examine the joint value of the singed allowances. These allowances are available till net 450,000 HUF/year on privileged, 32.5% taxation. Over this we have to count with 38.35% burden.

If you have questions, please consult us at andrea.makar@bdo.hu or +36 70 458 7247 at any time

|